Helping kids organize their money through teaching and technology

Our kids are good savers. They stash most of their money away to plan for big purchases.

The most difficult part of this habit was trying to keep track of it all. There were random bills and coins placed here and there. We’d take trips to the store and they didn’t recall how much they had to spend on something. It was difficult to remember what they had paid tithing on and what was yet to be tithed.

I know the importance of a personal budget and keeping track of money for adults.We decided to get organized and help our kids take a more intentional approach to their money as well. It is good training for the future and it’s much easier on Candace and me.

We created the Youth Personal Finance Record for use in our family. It is a Numbers spreadsheet that can be used on any iPhone, iPad, or Mac. (Download available at the end of this post.)

Talk with your kids about money

We sat with the kids to see how they would like to organize their money. It was decided that they would like to save ten percent for tithing and ten percent for savings. The rest they would spend however they’d like to do so.

We talked to them about the role of a bank. Since they are young, we decided to open an account with Mello Bank (us) and keep a ledger for each of them.

Whenever they receive money, they make a “deposit” with us and we update the ledger. It is fun to watch as they realize that digital money is the same as cash in hand without the stress of losing it.

They all felt comfortable with the plan.

An Example Youth PFR

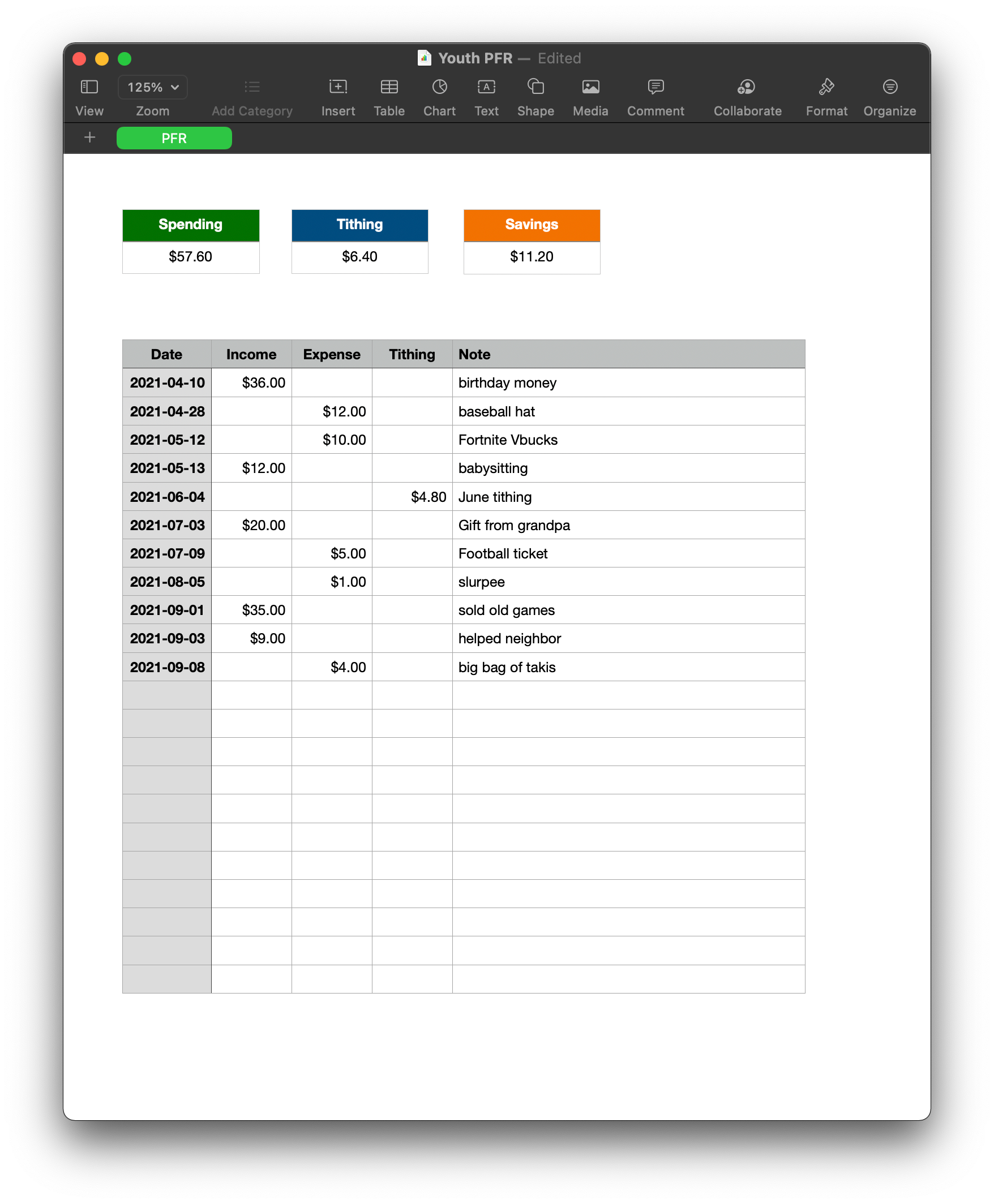

The spreadsheet consists of three automated main categories for and five columns for recording:

Spending – This is the total amount that each child has to spend at anytime. Eighty percent of each deposit goes here.

Tithing – This is the amount of tithing that needs to be paid. It is a running total. Ten percent of each deposit is shown here.

Savings – This is the amount that goes to savings. Ten percent of each deposit is shown here. Spending from this category requires permission from parents. The kids anticipate that this will go toward a large purchase in the future like a car, a church mission, or an international trip.

Date – We record the date when any transaction happens

Income – All deposits are entered here whether it is a gift or earned money. They give us the cash and we record it while sitting with them. When a deposit is made, it is automatically divided between the top three categories.

Expense – All purchases are recorded here. This column subtracts from the “Spending” category

Tithing – When tithing is paid, it’s added here. It only subtracts from the “Tithing” category.

Note – We all decided that it would be a good idea to require a note for every transaction. This way they can go back and see the things they spent money on and decide if it was worth it in the long run.

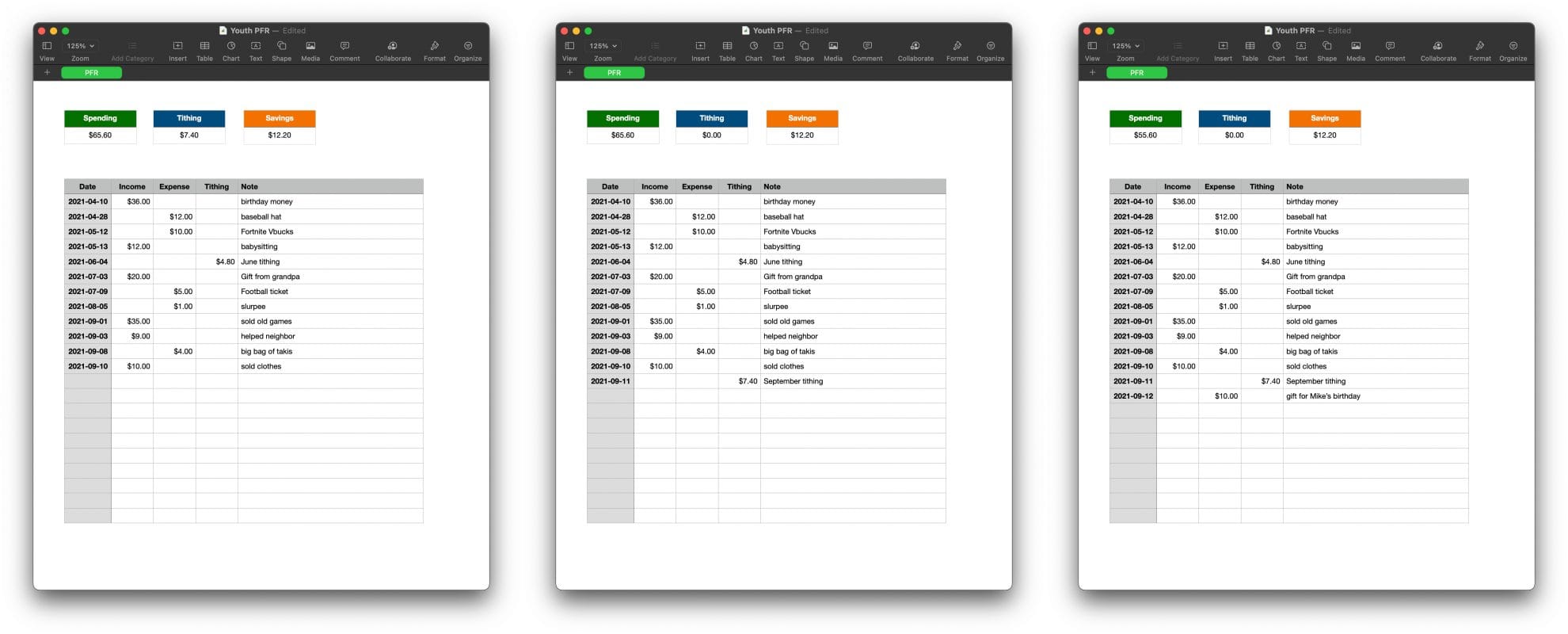

In the images above, you’ll see the changes that are made when a deposit, tithing, and expense is recorded. Note that the top categories change as items are recorded. (tap to enlarge)

The Benefits of Organization

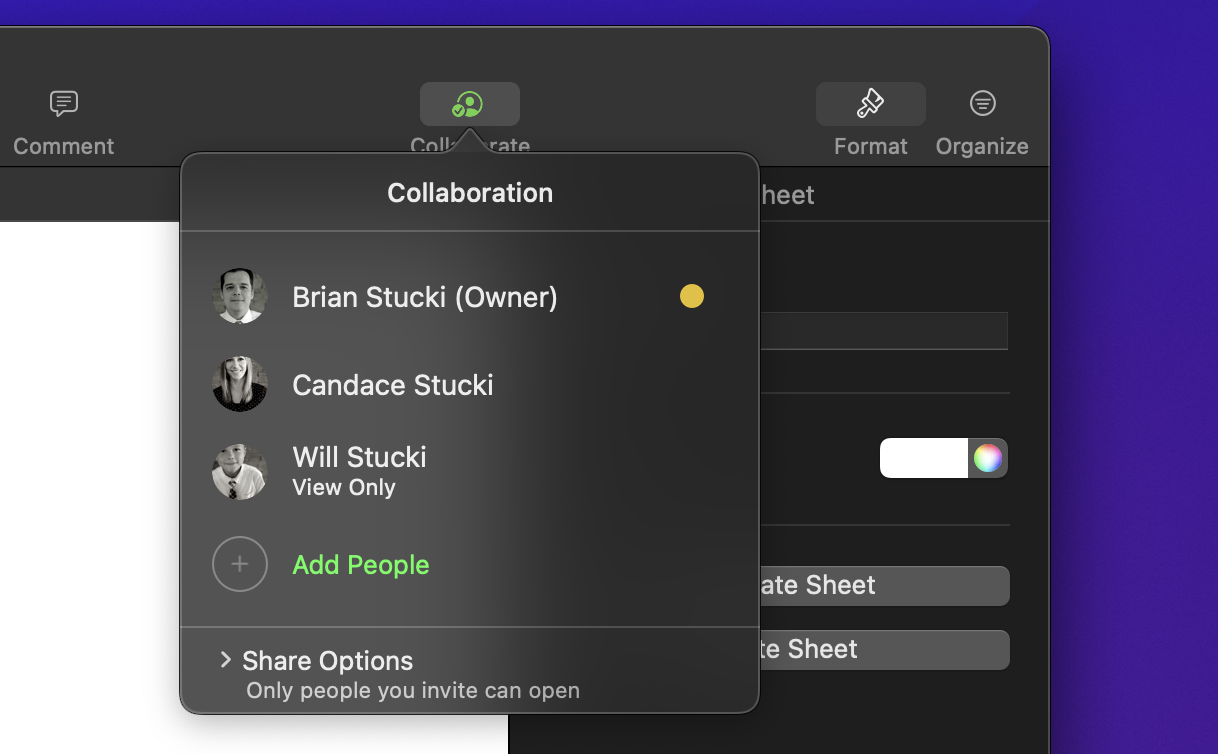

We created a spreadsheet for each kid and then shared it with only them through iCloud. This allows them privacy and direct access anytime from their phone or the family Mac.

My wife and I can edit the document (like a bank would) and our children can view it. They are encouraged to talk with us about their purchases, but they make the choice on their own and then we all record it together.

This new way of organizing their money has encouraged more conversations about financial matters. This is a sorely lacking subject in school. There is some real benefit to talking about finances at home. It’s fun to watch them learn, understand, and then connect the dots on just how powerful money management can be in their life.

And I no longer have to organize random piles of small bills and coins.

If you’d like to download a blank copy of the Youth Personal Finance Record to use in your family, you can do so with the link below. I’d love to hear how it goes.

Youth Personal Finance Record.NumbersDownload

Feedback? Send me an email.