A Copilot for your Budget

I will always remember the first time I read “The Millionaire Next Door.” It was life changing. The written description of savers and spenders would bring people to my mind that I knew and in some cases admired. The book helped me determine what path I would take toward self reliance.

One of the main themes of the book is summarized neatly in this quote:

“The foundation stone of wealth accumulation is defense, and this defense should be anchored by budgeting and planning.” Thomas J. Stanley

I have always believed that keeping a budget is about more than saving money. Budgeting is a practice of self control. It can increase humility and offers a sense of accomplishment. Keeping a budget will help you determine which purchases bring real joy and what ends up a waste of money.

I have written before about a template for making a simple budget. I recommend that simple and free process for everyone.

With the budget set, how do you keep track of your progress? I use CoPilot. It’s an iPhone app that tracks all of your spending and saving.

Update Dec 2022: Copilot also has a Mac app now. It’s everything you love about the iPhone app, but also has great keyboard shortcuts!

Update Oct 2024: Copilot is on the iPad now too. It's so nice to have it on all three platforms.

- Support is superb. It’s all in-app and incredibly quick and friendly.

- One of the useful things for me was identifying price creep on Internet service, car insurance, cell phone, etc. These services tend to inch up a dollar here and ten dollars here. That was always hard for me to track before.

- It’s like Mint, but private. And ad free.

It requires a little effort to setup but is mostly automated after that. It will sync your online accounts and also your expenses.

Copilot is $9 per month. You can use code 7QJWJG for two free months to be sure it works for your situation. This is especially helpful because the app will go through past expenses and help you identify recurring charges to start your budget. Give it a few days to do it’s work thoroughly. Even if you don’t keep the service, you will get a good look at the way you spend your money.

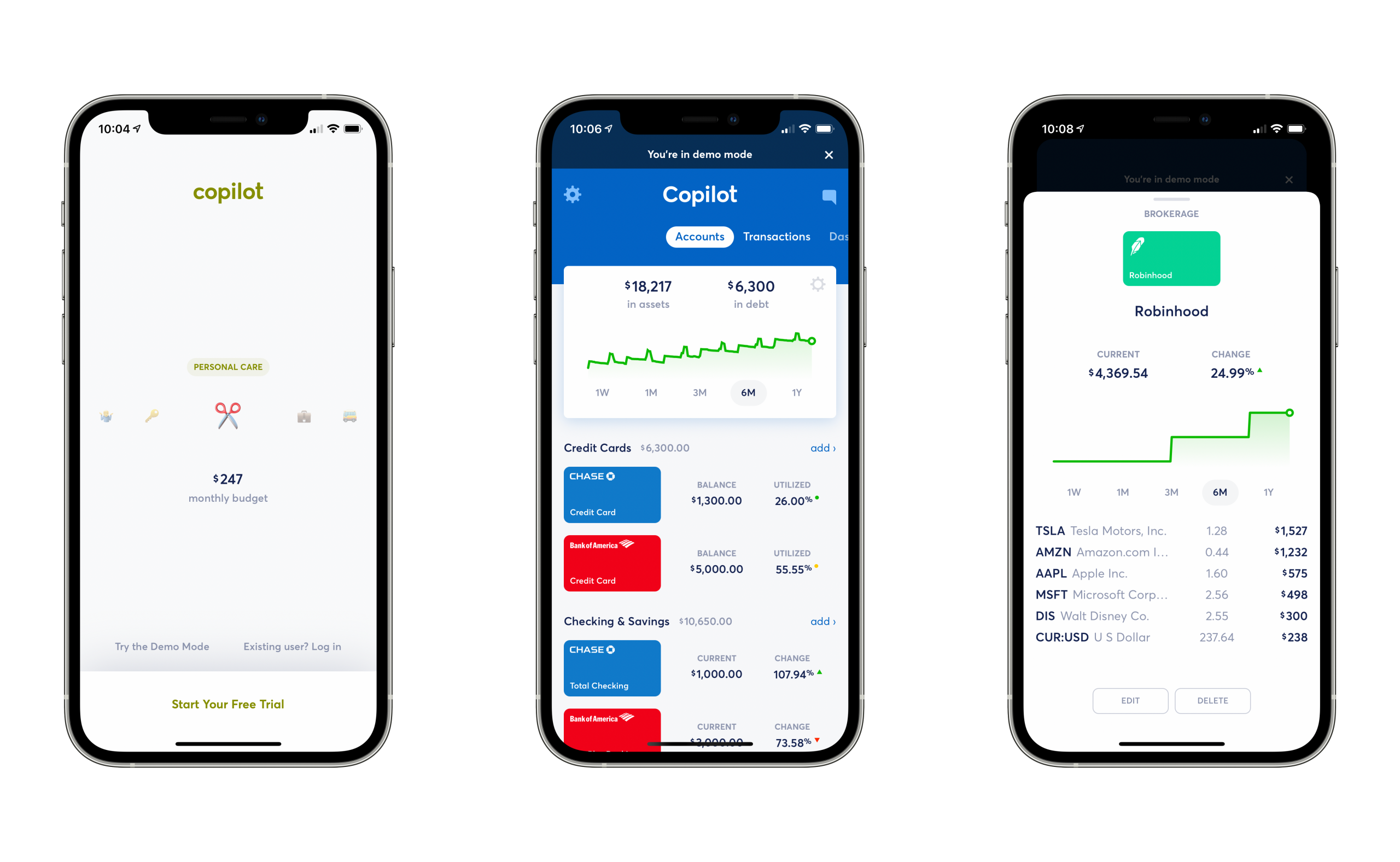

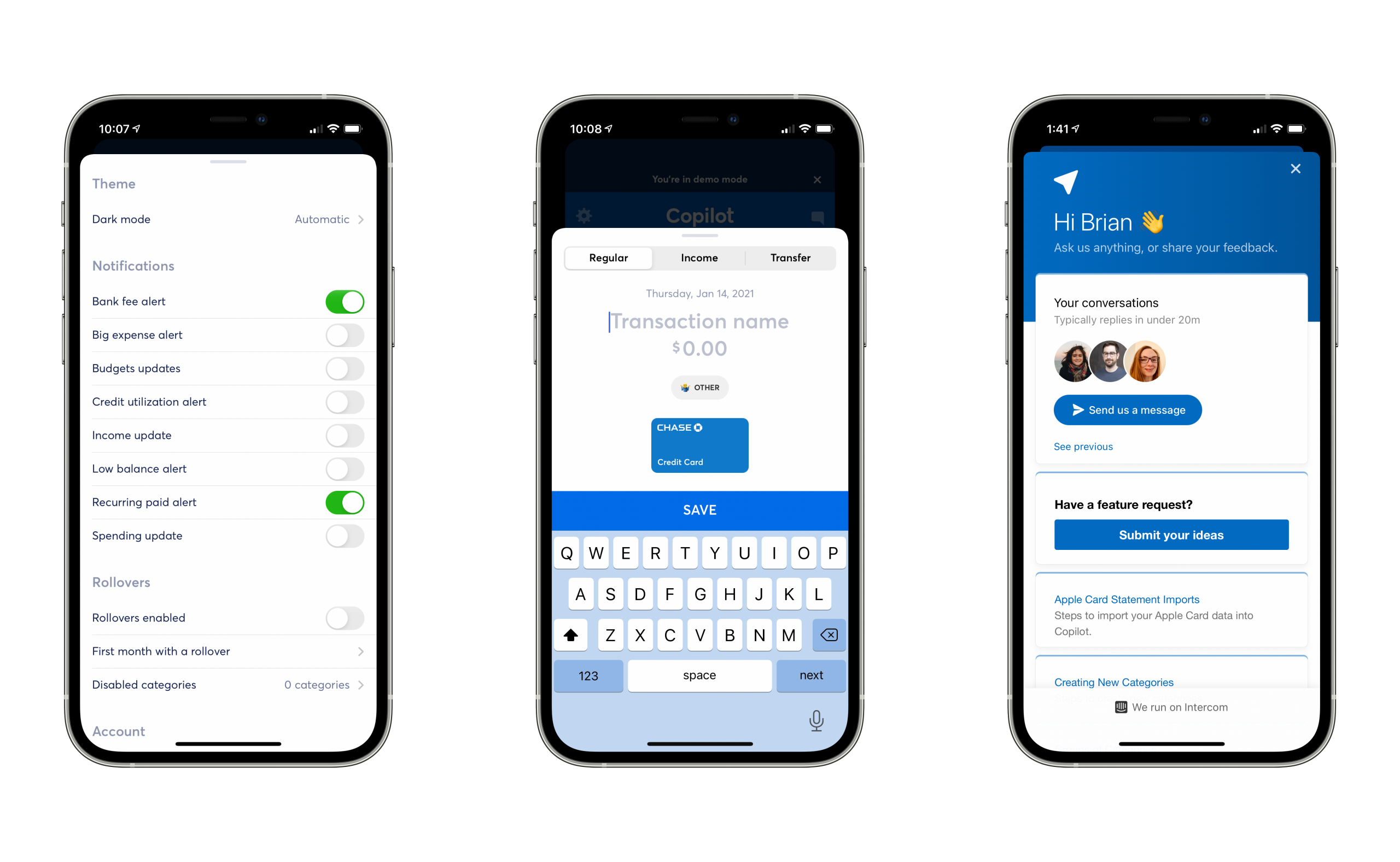

A Screenshot Tour

When I hear about a new app, I find it most helpful to see the app in action. Here are some screenshots (using generic data) so you can get an idea of the setup:

- The app allows you to start in Demo Mode so you can get an idea of the layout

- You start by connecting all of your online accounts. This includes checking, savings, brokerage and retirement accounts.

- The main “Accounts” page will show you your total net worth.

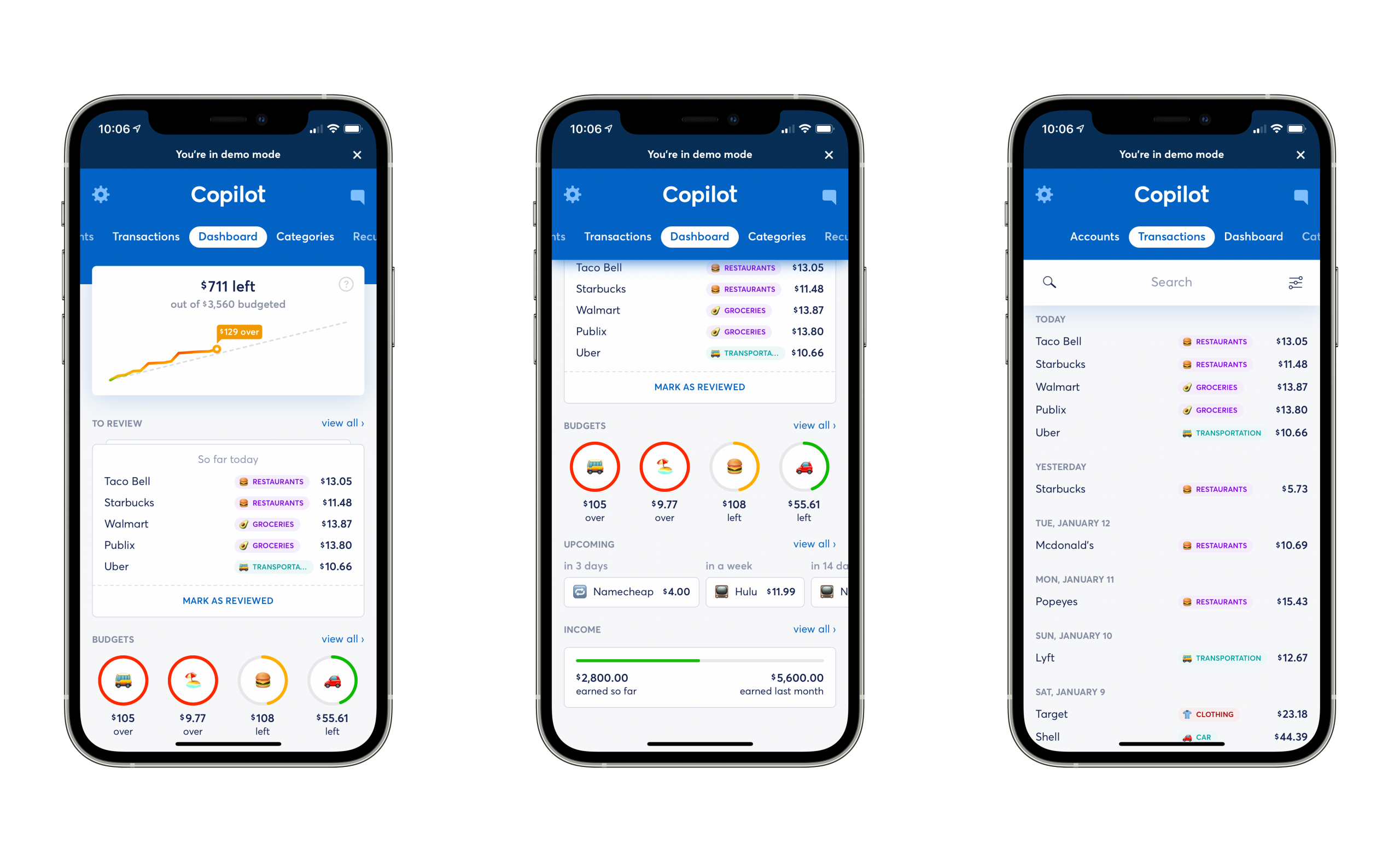

- As new transactions happen in your accounts, you will be able to review and confirm each transaction.

- As you categorize them, they will be applied against your budget and show you how you are doing for the month.

- Track your income as well to see how you progress month to month.

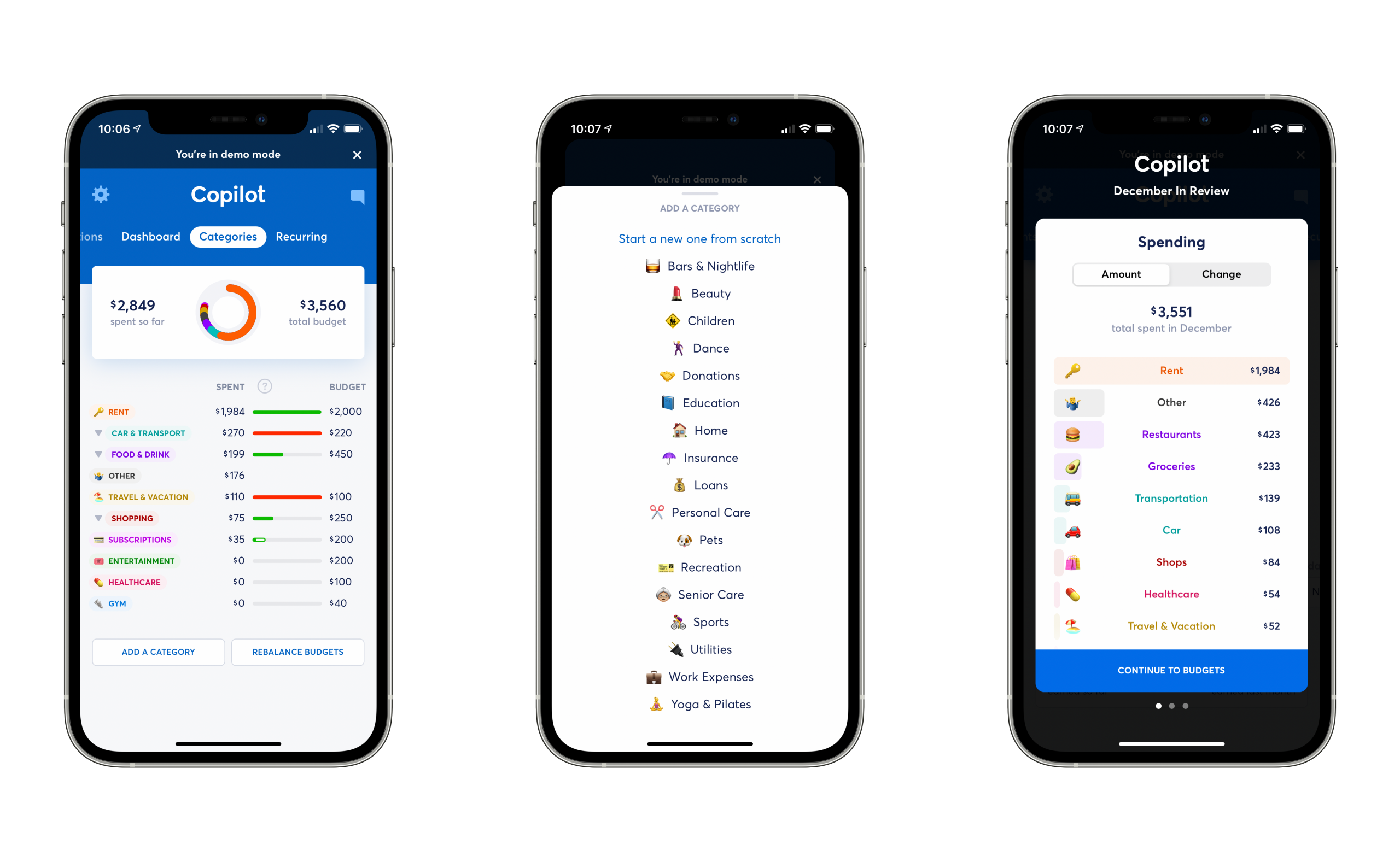

- You can create categories to set where your charges are applied toward your budget.

- At the end of each month, there will be a review to see how your month went.

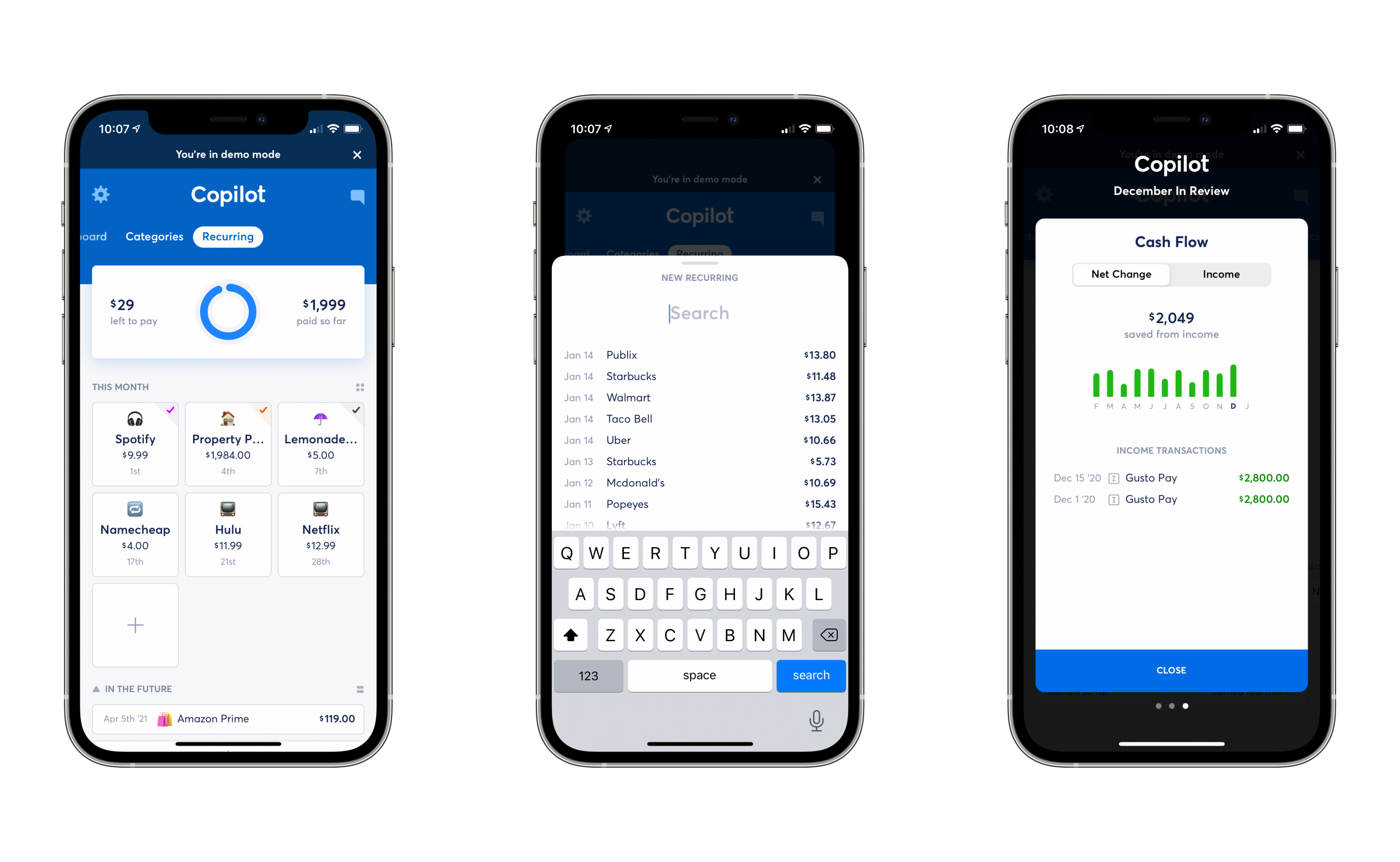

- Setup your recurring charges to see how they change from month to month. The app will also let you know when these expenses are on the horizon so you’re not caught off guard.

- A look at the recurring charges will really help you determine if your money is going toward the things in your life that offer the most happiness and progress.

- Tracking your income over time will also help you spot your best/worst performing months.

- You have some settings for personalization.

- You can add manual transactions if you purchase something with cash.

- The support is built right into the app.

Conclusion

As I have previously written:

Sometimes people will convince themselves that they spend less than they actually do so they don’t feel guilty. What is the point? If you are going to budget your money, it’s important to be completely accurate in order to celebrate the progress.Brian Stucki – A Scorecard for Life

It is worth it to get a handle on your finances. Wealth is not income alone. “Wealth is more often the result of a lifestyle of hard work, perseverance, planning, and, most of all, self-discipline.” (Stanley)

If you give CoPilot a try, I’d love to know how it goes for you.